White paper ‘Successful e-invoicing’

When your organisation starts to use e-invoicing, it is useful to have a step-by-step plan that helps you to get an overview. What issues are important, what choices need to be made and what suits your organisation best?

The step-by-step plan on this page is part of the white paper ‘Successful e-Invoicing’. You can download the entire whitepaper for free via the button below.

Roadmap e-invoicing

Step 1: Develop a vision for e-invoicing

Much has been written about the benefits of e-invoicing, but what should organisations do to cash in on these benefits? In addition, many organisations switching to e-invoicing discover hidden savings. What solutions are there and what is their savings potential?

Handling

Savings on handling is the most discussed savings potential. As invoices are fully processed electronically, manual processing of an invoice is no longer necessary.

Exceptions

Because there is less chance of errors in the process, there are fewer exceptions such as incorrect payments, invoices that are wrongly not paid or invoices that are wrongly paid. This saves repair costs and improves the relationship between supplier and customer.

Cash Management

While this does not apply to every organisation, long lead times can cause organisations to incur penalty interest or miss out on discounts.

Besides the direct financial benefits, there are a number of indirect benefits:

Control

The organisation gains more control over finance by having real-time visibility into open invoices, matched invoices and line-level invoice details.

Insight

Having real-time information about invoices and the invoicing process gives the organisation better insight into supplier and customer performance. With these insights, the organisation can work on smarter, more efficient invoice processing.

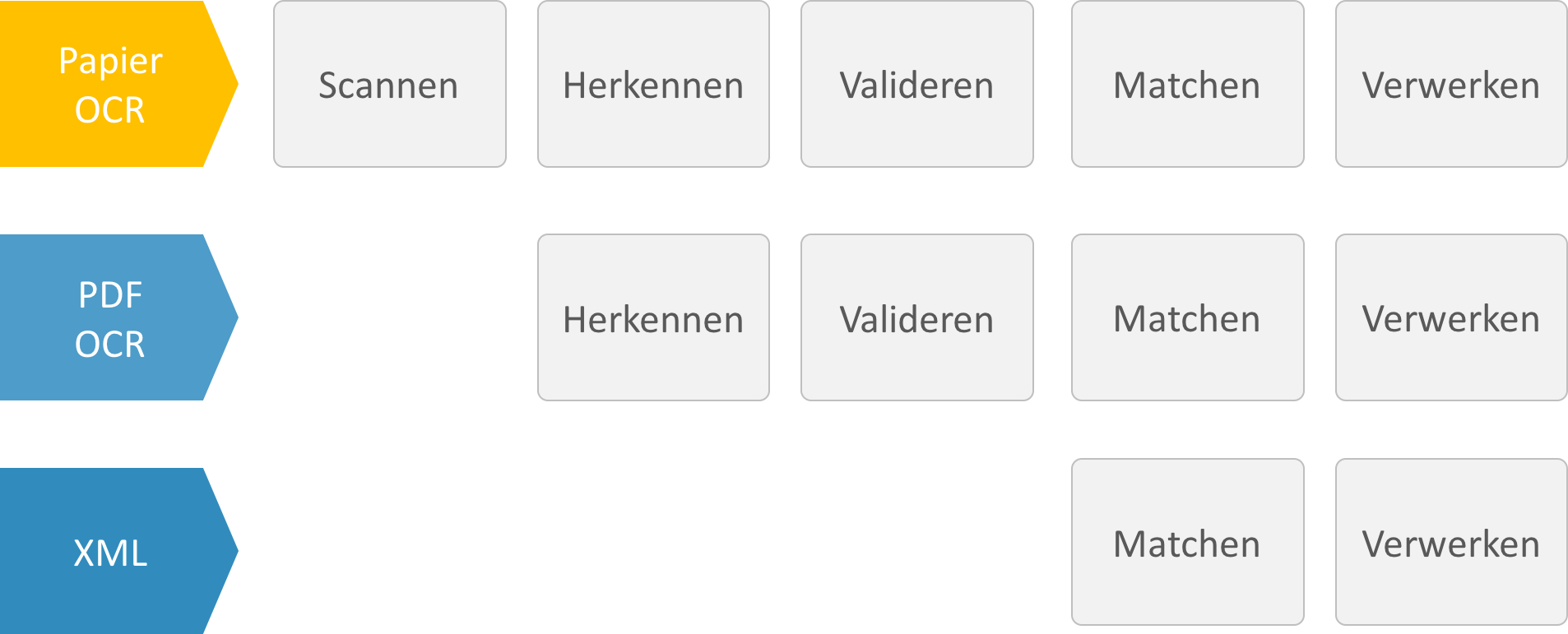

OCR: higher costs but faster results

Optical Character Recognition (OCR) is the conversion of text into an electronic format that can be processed by software. OCR is often used by companies to quickly process paper and PDF invoice flows, without asking the supplier for an XML invoice.

Converting a paper or PDF invoice to an e-invoice (‘recognising’) often consists of 2 steps:

1. OCR: Recognising values and texts, such as ‘€125.50’ or ‘Van den Berg BV’. Nowadays, many PDFs do not require this, as the texts are already in computer-readable format in the PDF.

2. Capture: Interpreting the meaning of the value or text, for example: ‘amount excluding VAT’ and ‘Company name supplier’. Some OCR programmes are self-learning, so when a new invoice format is created, the programme needs to be configured once.

The advantage of OCR is that the supplier does not need to make any adaptation to its systems.

XML: lower cost, but impact on supplier

Processing XML invoices offers a number of additional advantages over OCR. These benefits are:

– XML invoices do not need to be checked for possible errors that may occur when interpreting a PDF. The content of an XML invoice is always the exact same as how the supplier created the invoice.

– Although more and more OCR programmes are able to recognise invoice lines, an XML invoice can contain more information and be processed correctly. Especially for larger companies, this invoice line information is needed for the approval process.

– XML is often seen as ‘machine readable’. Within the XML, the PDF can also be included as an attachment. As a result, XML combines the efficiency of an automatically processable format with the advantages of a human-readable format.

Until XML is implemented in every software package, using OCR provides ‘quick wins’.

XML orders: not suitable for every customer-supplier relationship, but offers far-reaching savings

Organisations that have been doing e-invoicing for some time often take the next step: automating order flows. This step provides great benefits for both customer and supplier:

– The supplier can automatically process an e-order in the system. This minimises the risk of errors when entering the order. In addition, the supplier can easily create invoices, even for partial deliveries.

– The customer can automatically match incoming invoices with the original order. If the invoice falls within agreed margins, it can be automatically approved and a payment can be prepared.

What is needed to eventually also reap the benefits of e-ordering?

1. Purchasing software or financial software capable of creating electronic orders.

2. A service provider (transaction network), which links the customer’s procurement software with the supplier’s software.

3. A streamlined procurement process in which purchase orders are unambiguously registered and agreements are made with suppliers on the exchange of orders.

Step 2: Understand your software landscape

When switching to electronic invoicing, you should look closely at your current IT landscape: perhaps one of your current software systems can help with the switch. Or perhaps your procurement software can connect with your suppliers. Therefore, think about your business process and supporting IT beforehand.

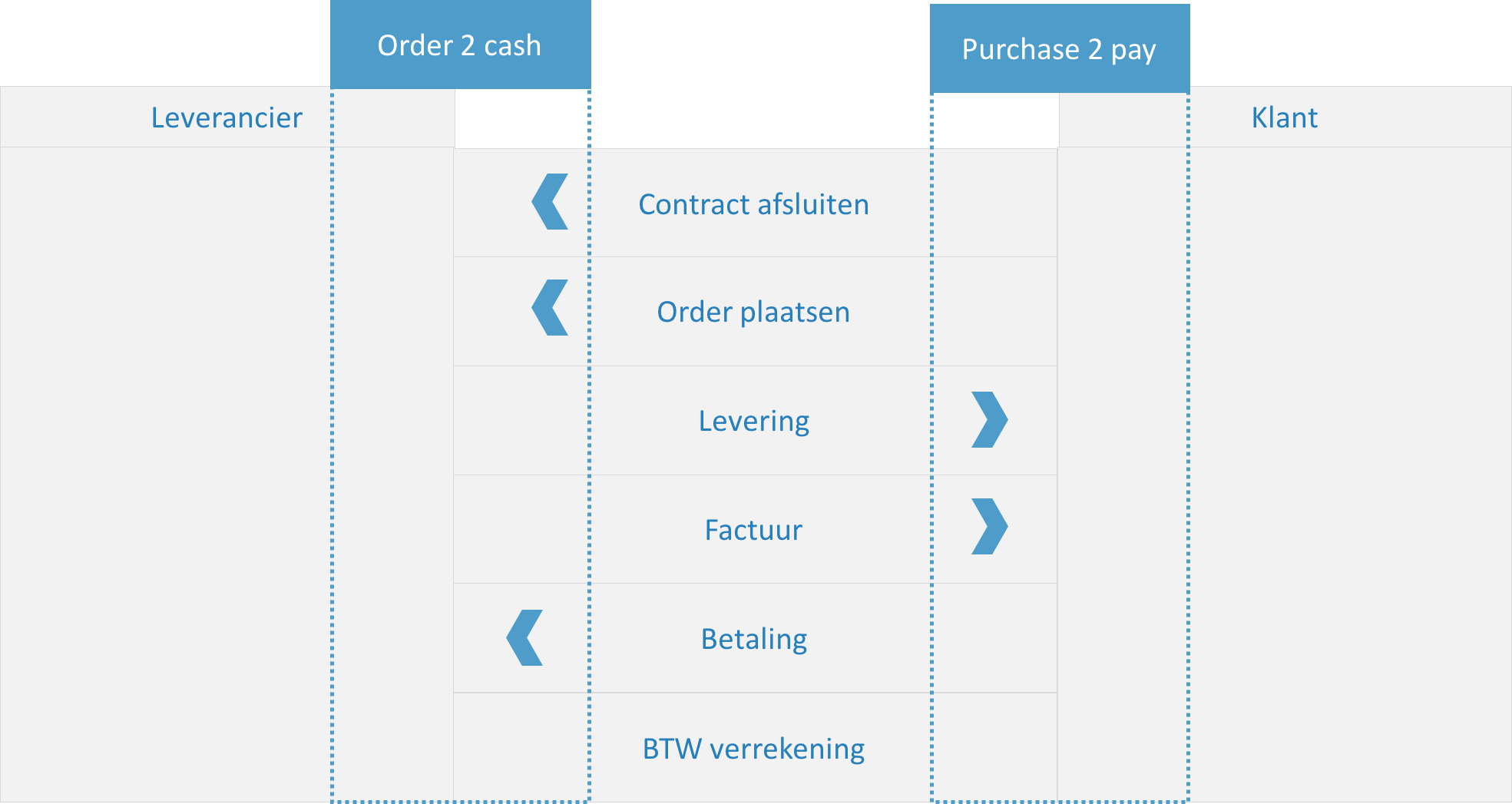

Invoicing as part of a bigger picture

Invoicing is part of a bigger picture. Many invoices originate from an order or from a contract where details about the order and the supplier are logged (metadata). An invoice accompanies a supply of a service or product, with the resulting performance statement or packing slip. Finally, after invoicing (generally), payment and VAT remittance takes place. This process is often referred to as the purchase-to-pay (also called purchase2pay) process.

Invoicing is interaction between suppliers and customers

In addition, all these processes require interaction with your supplier. Your supplier has a counter process for each process: for example, your supplier registers an order, creates an invoice and processes a payment. The process at the supplier is called order-to-cash (also called order2cash).

Invoicing spans multiple systems

Therefore, there are also several departments and processes within an organisation that have an interest in e-invoicing and there are several supporting IT facilities involved. So it is not obvious that e-invoicing should be a part of financial software. Other software may also have e-invoicing as an option.

Key supporting IT

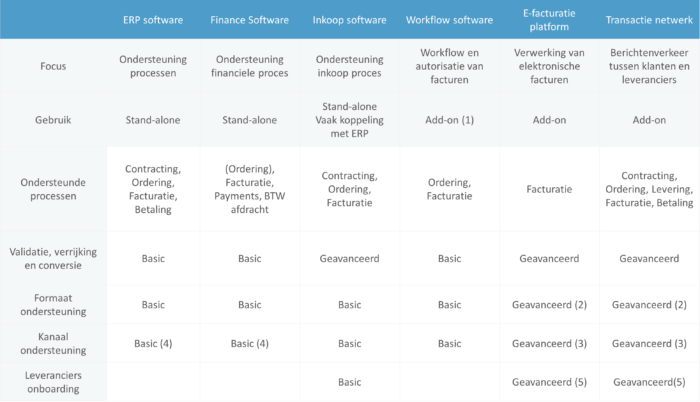

When an organisation wants to receive electronic invoices, it can be supported by different software systems:

– ERP packages

– Financial packages

– Procurement software

– Workflow / OCR software

– E-invoicing software

– Transaction networks

Each software serves a different part of the organisation’s purchase2pay process.

ERP software

ERP (enterprise resource planning) software is the software that larger companies in particular use to support business processes such as: production, inventory management, contract management, but increasingly also finance and procurement. More and more ERP packages are making e-invoicing a standard feature or an additional module within their environment.

Accounting or financial software

Financial software (also called accounting software) is the software that supports an organisation’s financial process. Often, this software includes functionality for invoicing, accounting, payment and VAT settlement and remittance.

Procurement software

Procurement software supports the procurement process. Typically, procurement software provides facilities for registering and sending an order. In addition, it often has the ability to receive invoices and do matching between invoice and orders. Finally, procurement software usually has integration with the ERP or financial system.

Workflow software

Workflow software is used for routing invoices through the organisation and authorising an invoice. It is then combined with software for scanning paper or PDF invoices and converting them into booking proposals.

E-invoicing platforms

E-invoicing platforms are platforms that can be linked to ERP or financial systems. Platforms often specialise in validating, converting and booking electronic invoices. E-invoicing platforms typically have no functionality for accounting or procurement support.

Transaction networks

A transaction network is software aimed at supporting interactions between you and your customers and suppliers. In addition to the invoice, these networks usually support other documents such as the order and packing slip, and in some cases payment. Sometimes a transaction network also supports supplier onboarding. Connect transaction networks with your organisation’s existing ERP or financial system.

Comparing different software

It is difficult to compare software packages because they have different functions. Regarding

e-invoicing, the packages often have their own angle. The table below shows the different

perspectives of software packages on e-invoicing.

1. Sometimes workflow software is part of finance or procurement software.

2. E-invoicing software and transaction networks differ in their ability to support new formats. Ask especially which formats are supported. Think of: UBL (+variants), HR-XML, INSBOU, Energy e-invoice etc.

3. Transaction networks differ in the extent to which digital channels are supported. At a minimum, aim for ‘open networks’ that are part of Peppol, but also check whether the party supports other channels. If you do not, you risk your suppliers not being able or willing to connect.

4. Some financial packages or procurement software packages support Peppol as a channel.

5. Transaction networks differ in the extent to which they unburden your suppliers during onboarding.

Step 3: What you need to know about supplier onboarding

It happens all too often that companies invest in a solution for exchanging electronic invoices and/or orders, but its actual use is disappointing. And then the business case for e-invoicing turns out to be a lot more negative than expected. The reason is that in practice it is difficult to persuade suppliers to start e-invoicing: so-called ‘supplier onboarding’. This is often the bottleneck in a successful e-invoicing project: it is time-consuming, adoption is disappointing and it often causes frustration for the supplier and the buying organisation.

Onboarding as part of an e-invoicing project is sometimes done by the buying organisation’s e-invoicing service provider, but often the buying organisation has to do it itself. Whether you outsource supplier onboarding or do it yourself; having a good and well thought-out onboarding strategy is essential to its success.

1. Focus on longtail as well

Many buying organisations focus only on the largest suppliers. Although these together may account for 70 percent of invoice volume, in practice, adoption often does not exceed 20 to 40 percent. Therefore, activate not only the top suppliers but also the smaller suppliers and ensure that they are efficiently onboarded.

2. Supplier choice

Make sure the supplier can start using e-invoicing without having to make major changes to their process. This can be done by ensuring they can e-invoice from their own software, or by providing a low-threshold portal through which they can easily create and send e-invoices. Therefore, make sure you support Peppol, as it gives your supplier freedom of choice in how they submit their invoice.

3. Treat your supplier as a customer

Involve your supplier early in the process and help them embrace e-invoicing step by step. As an organisation, you can play an educational role in taking your suppliers along.

4. E-invoicing is the beginning, not the end point

Think of e-invoicing as the start of a partnership, where supplier and purchasing organization continually work together to create a more efficient and user-friendly invoicing and ordering process. This makes e-invoicing not a necessary evil for your supplier, but an opportunity to increase ‘customer intimacy’ with the buying organisation.

5. Give your supplier real benefits

Make sure your supplier benefits from starting with e-invoicing. This can be done, for example, with an accelerated payment or a payment discount.

What does onboarding small suppliers get you?

Most organisations focus on onboarding the big suppliers: they often send a lot of invoices to your organisation and therefore cost savings are high with this group of suppliers.

However, onboarding small organisations can bring great benefits. Research shows that small organisations have higher invoice failure rates than large organisations. So these invoices are more likely to lead to extra work in your financial administration. In contrast, large organisations often have a highly standardised and stable billing process. So by onboarding small suppliers, you save quite a lot of errors and phone calls to your finance department.

Can small organisations e-invoice?

In recent years, sufficient solutions have emerged for small suppliers to e-invoice.

For example, many financial packages have implemented the UBL standard in their software. As a result, users of this software can easily send e-invoices.

Small business owners who create their invoices in Word or Excel can invoice electronically by using an invoice portal: an online programme where e-invoices can be easily created and sent.

Step 4: Implementation approach

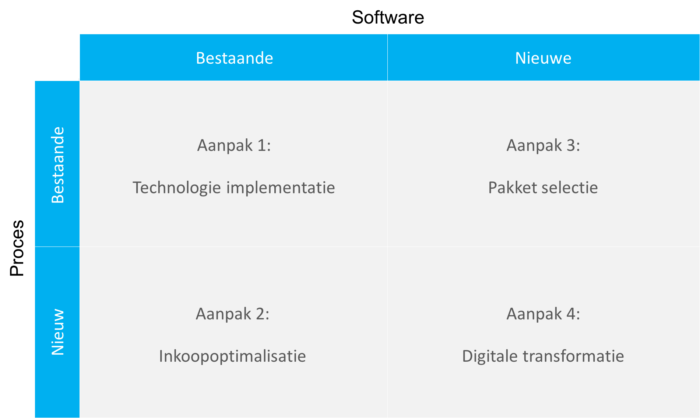

Implementing e-invoicing is often seen as an extensive project. It is often part of a larger programme that considers optimising the procurement process, choosing (invoicing, purchasing, financial or ERP) software or ‘digitally transforming’ business processes. But which approach is most likely to succeed?

Most organisations embarking on e-invoicing use one of the methods below:

Approach 1: Technology implementation

Technology implementation occurs when an organisation wants to start using e-invoicing without making major changes to financial or procurement processes and without purchasing new software. E-invoicing functionality is often switched on in existing financial or procurement software. Or the procurement software is connected through a ‘transaction network’. The impact of such an implementation is limited to mainly IT. The result is that the organisation receives and processes invoices in UBL in the same way as before the implementation.

Tip: to actually receive e-invoices, it is advisable to organise at least one information or activation campaign.

Approach 2: Procurement optimisation

Procurement optimisation occurs when an organisation optimises or redesigns its procurement processes (Business Process Redesign, BPR).

These could include improvements in placing orders, rationalising the supplier base or changing the process of ordering, receiving and invoicing. The focus of such procurement optimisation projects is on improving the way the organisation handles orders, performance statements and invoices. E-invoicing then often becomes part of existing procurement or ERP software, but the impact is bigger than a technology implementation because the new way of working has to be embed in the organisation. The costs for such an optimisation project are higher than for a technology implementation, the potential savings mostly too.

Approach 3: Package selection

In a ‘package selection’ project, an organisation looks for software to support existing business processes such as Finance & Procurement. Here, the selection may focus on new ERP, financial, procurement or workflow software (or a combination). The impact on the business process is limited. There will be no business process redesign, software

is implemented that supports the existing business process. Increasingly, the topic of e-invoicing is part of an RFP, in a package selection. More and more packages support e-invoicing by default.

Tip: not all ERP, financial, procurement or workflow software supports all building blocks of e-invoicing to a sufficient extent. In that case, a transaction network as a “plugin” to the chosen software can still provide the desired additional functionality. Therefore, when making a package selection, consider treating e-invoicing functionality as a separate package selection (best-of-breed approach).

Approach 4: Digital transformation

Digital transformation is digitising the Finance or Procurement department. A project in which an organisation reshapes its processes using digital technology. This involves not only redesigning processes, but also implementing software to support them. This is often initiated by the Finance or Procurement department. In Finance, the primary focus is on improving the invoicing process and improving insight and control for the controller/finance manager. In procurement, the focus is on improving the ordering and delivery process. Often collaboration is sought between Finance and Procurement. Setting up an approval workflow or optimising accounts receivable management can also be part of the transformation project.

While the first step for many Finance departments is to digitise invoice flows using OCR software, more and more organisations are also turning to receiving fully electronic invoices. In addition, more and more financial software packages support e-invoicing by default, making e-invoicing increasingly part of a ‘digital transformation’ project.

Do you have any questions or want more information?

Then contact e-procurement expert and consultant Jaap Jan Nienhuis